4 2: Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries Business LibreTexts

During the year, it collected retainer fees totaling $48,000 from clients. Retainer fees are money lawyers collect in advance of starting work on a case. When the company collects this money from its clients, it will debit cash and credit unearned fees.

Accrued Salaries

Once a company’s books are closed and the accounting cycle for a period ends, it begins anew with the next accounting period and financial transactions. The accounting cycle is a collective process of identifying, analyzing, and recording the accounting events of a company. It is a standard 8-step process that begins when a transaction occurs and ends with its inclusion in the financial statements and the closing of the books. Salaries Expense increases (debit) and Salaries Payable increases (credit) for $12,500 ($2,500 per employee × five employees).

Types and examples of adjusting entries:

The mechanics of accounting for prepaid expenses and unearned revenues can be carried out in several ways. The expenditure was initially recorded into a prepaid account on the balance sheet. The alternative approach is the “income statement approach,” wherein the Expense account is debited at the time of purchase. The appropriate end-of-period adjusting entry establishes the Prepaid Expense account with a debit for the amount relating to future periods. The offsetting credit reduces the expense to an amount equal to the amount consumed during the period.

- For example, a service providing company may receive service fees from its clients for more than one period, or it may pay some of its expenses for many periods in advance.

- This means $150 is transferred from the balance sheet (asset) to the income statement (expense).

- At the end of the month, the company took an inventory of supplies used and determined the value of those supplies used during the period to be $150.

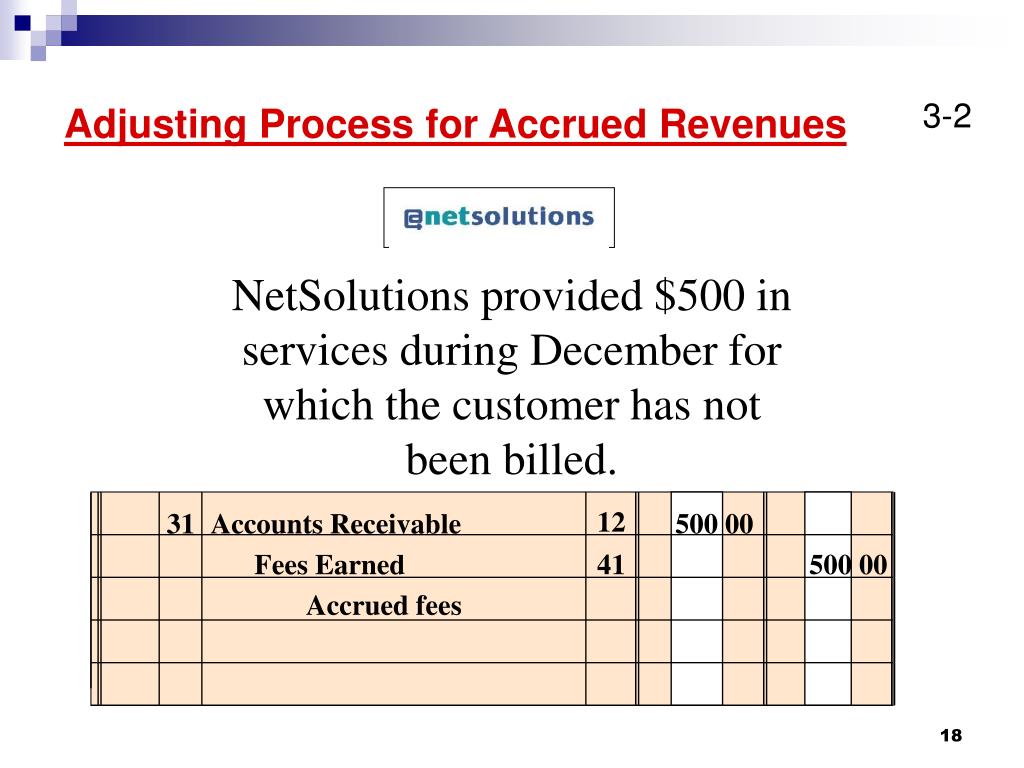

- This aligns with the revenue recognition principle to recognize revenue when earned, even if cash has yet to be collected.

- From gadget reviews to step-by-step guides, we’re here to inspire both seasoned chefs and kitchen beginners.

Adjusting Entries

Interest Revenue increases (credit)for $1,250 because interest was earned in the three-month periodbut had been previously unrecorded. At the end of the year after analyzing the unearned feesaccount, 40% of the unearned fees have been earned. Journal entries are recorded when an activity or event occursthat triggers the entry.

Chapter 4: Completing the Accounting Cycle

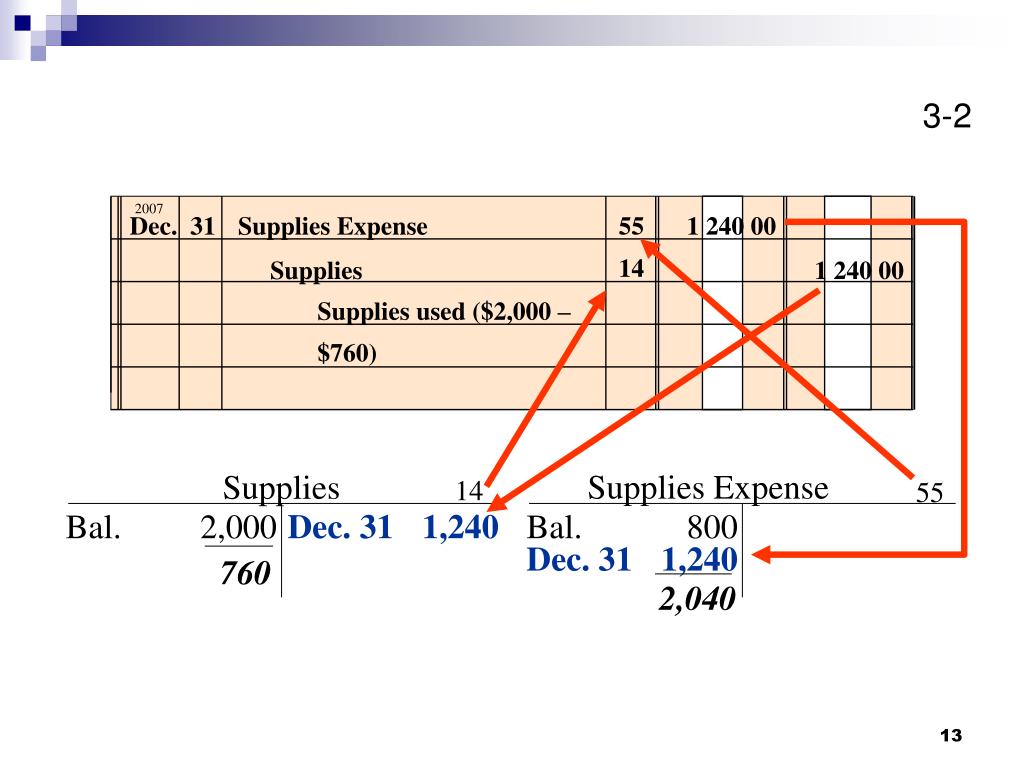

There is still a balance of $250 (400 – 150) inthe Supplies account. The balances in the Supplies and Supplies Expenseaccounts show as follows. Accruals are types of adjusting entries that accumulate during a period, where amounts were previously unrecorded. The two specific types of adjustments are accrued revenues and accrued expenses. In the last section, we took NeatNiks right up to the unadjusted trial balance at the end of the month of October.

What Are Benefits of the Accounting Cycle?

Ensure the orientation is correct, then press it firmly into the chair. If you have a top-activated chair, you might need to adjust the set screw after placing the chair back on its feet. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License tracking and recording cash sales in a bookkeeping system . This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax. This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax’s permission.

This may be useful for businesses needing to coincide with a traditional yearly tax schedule. It can also be easier to track for some businesses without formal reconciliation practices, and for small businesses. Did we continue to follow the rules of adjusting entries inthese two examples?

By the end of the asset’s life, its cost has been fully depreciated and its net book value has been reduced to zero. Customarily the asset could then be removed from the accounts, presuming it is then fully used up and retired. In the illustration for insurance, the adjustment was applied at the end of December, but the rent adjustment occurred at the end of March. In the second illustration, it was explicitly stated that financial statements were to be prepared at the end of March, and that necessitated an end of March adjustment.

The company needs to correct this balance in the Unearned Revenue account. Some nonpublic companies may choose to use cash basis accounting rather than accrual basis accounting to report financial information. Recall that cash basis accounting is a method of accounting in which transactions are not recorded in the financial statements until there is an exchange of cash. Cash basis accounting sometimes delays or accelerates revenue and expense reporting until cash receipts or outlays occur. With this method, cash flows are used to measure business performance in a given period and can be simpler to track than accrual basis accounting.

Atthe end of a period, the company will review the account to see ifany of the unearned revenue has been earned. If so, this amountwill be recorded as revenue in the current period. After the first month, the company records an adjusting entryfor the rent used. The following entries show initial payment forfour months of rent and the adjusting entry for one month’susage. The salary that the employee earned during the month might not be paid until the following month. For example, the employee is paid for the prior month’s work on the first of the next month.

Besides deferrals, other types of adjusting entries include accruals. In contrast, accrued rent relates to rent that has not yet been paid, even though utilization of the asset has already occurred. Long-lived assets like buildings and equipment will provide productive benefits to a number of periods. However, one simple approach is called the straight-line method, where an equal amount of asset cost is assigned to each year of service life. In order for information to be useful to the user, it must be timely—that is, the user has to get it quickly enough so it is relevant to decision-making. You may recall that this is the basis of the time period assumption in accounting.

Leave your comment